The anticipated approval of spot Ethereum (ETH) exchange-traded funds (ETFs) marks a significant milestone for the cryptocurrency market. As asset managers finalize their applications, the U.S. Securities and Exchange Commission (SEC) is expected to greenlight these funds soon, potentially leading to a new wave of investment in Ethereum.

What is an Ethereum ETF?

An Ethereum ETF is a financial product that allows investors to gain exposure to Ether, the native cryptocurrency of the Ethereum blockchain, without directly purchasing or managing the underlying asset. These ETFs track the price of Ethereum and are traded on regulated stock exchanges, similar to traditional ETFs. This structure provides a more accessible way for both retail and institutional investors to invest in cryptocurrencies, as it operates within a regulated framework, mitigating some of the risks associated with direct crypto investments.

The SEC approved the listing of spot Ethereum ETFs on May 23, 2024, following its earlier approval of Bitcoin ETFs in January. The approval of these ETFs is seen as a pivotal moment for the crypto industry, as it could help classify Ethereum as a commodity rather than a security, potentially shifting regulatory oversight to the Commodity Futures Trading Commission (CFTC). We are yet to see the first ETF listings for Ethereum and this is expected to happen this week. It’s imminent, with trading expected to commence as early as Tuesday.

Market Implications

The approval of spot Ethereum ETFs could lead to a price rally of up to 60% for ETH, mirroring the positive market reaction seen following the approval of Bitcoin ETFs earlier this year. Increased buying activity has already been noted on various exchanges, indicating heightened investor interest in anticipation of the ETF approvals.

Additionally, the competitive landscape among ETF issuers is expected to drive down management fees, making these investment products more attractive to potential investors. For instance, while Grayscale has set a higher fee for its main product, other issuers like BlackRock and Fidelity plan to charge lower fees, which could influence investor choices. It’s highly likely that this will attract substantial institutional investment, similar to the inflows seen after the approval of Bitcoin ETFs earlier this year.

According to my analysis these ETFs could see net inflows of up to $15 billion by 2025, which would drive up demand for Ethereum and potentially send its price soaring.

Increased Market Liquidity

The availability of ETH ETFs will make it easier for both retail and institutional investors to gain exposure to Ethereum without the need to directly purchase and store the cryptocurrency. This increased accessibility is expected to boost market liquidity, potentially reducing volatility and enhancing the overall stability of the Ethereum ecosystem.

Regulatory Developments

The SEC’s approval of ETH ETFs is seen as a significant step towards greater regulatory acceptance of cryptocurrencies. This decision could pave the way for the approval of ETFs for other major altcoins, such as Solana, and lead to a more diverse range of crypto investment products in the future.

And, there’s a positive sentiment spillover. The legitimacy and credibility brought by ETH ETFs could have a positive impact on the entire crypto market. Many analysts agree with me that the approval of Ethereum ETFs might drive Bitcoin to new all-time highs, fostering a bullish sentiment across the industry.

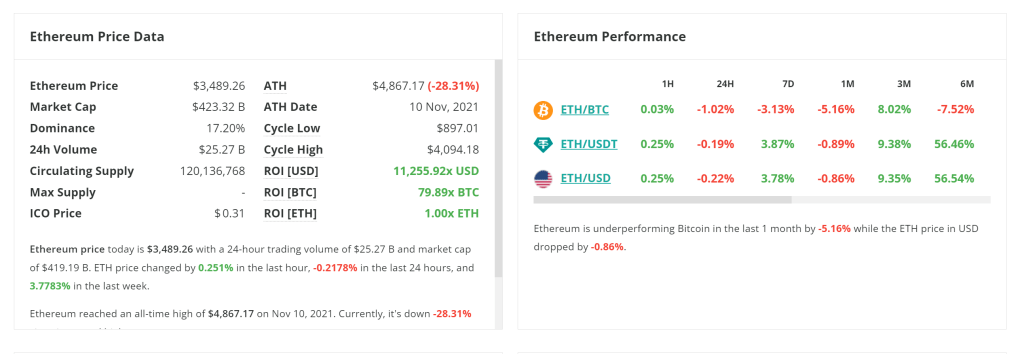

It’s interesting that in the wake of the first spot Ether ETF listing, the price of the token isn’t showing any signs of the bullish sentiment I’m talking about. The last week has seen merely 4% increase, which is not much, compared to the BTC price jump of 7% for the same period. This is most likely due to the speculators taking advantage of the news and we’re seeing a typical “Buy the rumour, sell the news” scenario right now. This is the short term dump that happens often at the launch of an ETF, but it’s usually followed by a rapid recovery and huge price rallies on the upside, which is what I expect will happen in the coming weeks.

Ether is still undergoing a market correction and it’s just 28% down from its historic ATH of $4867 which was printed on 10 Nov 2021 (just before the bear market began). During the first leg of this bull cycle, ETH failed to reach a new ATH, while Bitcoin, with the help of the ETFs that launched in January, has already recorded a new ATH of $73,628 in March this year. With the ETF opening this week, Ether is posed to make a new rally and challenge its previous ATH at last. Stay tuned for more market analyses and news.

☝These are my opinions, not financial advice, always DYOR.

Recommended:

👉 Sign Up for the Crypto Corner Newsletter and get more insight on the crypto markets, new releases and updates, plus my personal choice of coins to trade: https://www.ojjordan.com/crypto-corner

👉 Sign Up for the Crypto Corner Newsletter and get more insight on the crypto markets, new releases and updates, plus my personal choice of coins to trade: https://www.ojjordan.com/crypto-corner

👉 LearnCryptoNow is the go-to place to get valuable resources and learn more about blockchain tech and all things crypto-related: https://www.learncryptonow.com/

👉 LearnCryptoNow is the go-to place to get valuable resources and learn more about blockchain tech and all things crypto-related: https://www.learncryptonow.com/

👉Brave Browser is my top choice for extra security while browsing online. It is privacy-oriented, web3-enabled and blocks unnecessary cookies and much more: https://brave.com/ojj095

👉Brave Browser is my top choice for extra security while browsing online. It is privacy-oriented, web3-enabled and blocks unnecessary cookies and much more: https://brave.com/ojj095

👉Token Metrics is the platform I use for uncovering unknown gems and to monitor my crypto watchlist. They have the most detailed statistics and analysis for all major cryptocurrencies and price predictions to help you find the right coins to trade and the right time to buy/sell – give it a try and get 10% discount: https://bit.ly/token_metrics

👉Token Metrics is the platform I use for uncovering unknown gems and to monitor my crypto watchlist. They have the most detailed statistics and analysis for all major cryptocurrencies and price predictions to help you find the right coins to trade and the right time to buy/sell – give it a try and get 10% discount: https://bit.ly/token_metrics

Want to know how to make money by investing in crypto?

Grab a copy of my best-selling eBook “Learn Crypto” to find out all about the cryptocurrency market, the different blockchains and the “Do”s and “Don’t”s of how to build a successful crypto portfolio. It’s now in its second edition.Find out more: LearnCryptoNow.com

“Crypto Wallets” is a Free eBook to guide you in choosing the right wallet for you. All the popular Hot and Cold Wallets are reviewed in this useful guide, most of which I personally use, or have used in the past. Self-custodial and custodial services too.

Find out more at: https://www.ojjordan.com/crypto

⚠️ DISCLAIMER ⚠️

The information contained in this video is for informational purposes only. Nothing herein shall be construed to be financial or legal advice. The content of this post reflects solely my own opinions. Purchasing cryptocurrencies poses considerable risk of losses.

Quote Of The Day

“Don’t count the days; make the days count.” – Muhammad Ali Life is precious, so make each day meaningful and impactful rather than just…

On This Day In Bitcoin History

Bitcoin hit $50,000 for the first time on this day in February 2021

Quote Of The Day

“Success is the sum of small efforts, repeated day in and day out.” – Robert Collier Consistency in small actions builds the foundation for…