Sometimes we need a light-hearted quote to just uplift and brighten the day. Here's one: "Why does a slight tax increase cost you $200 and a substantial tax cut save you 30 cents?" – Peg Bracken 🌄 #laughmore

Quote Of The Day

"The distance between your dreams and reality is called action." Dreams become tangible when you take purposeful steps toward their realization. 👍 #Prioritize #EmpowerYourself

My Hardware Wallet Choice in 2026: the Ellipal Xcard

https://youtu.be/Byy-uBf-Jco For those who like a portable, compact and lightweight, simple-tap use cold wallet that can store numerous tokens on all the popular networks... well, this is just the right device for you. First, a few key things to know about this cold wallet. 🔍 What Is the Ellipal Xcard? At its core, the Ellipal … Continue reading My Hardware Wallet Choice in 2026: the Ellipal Xcard

Quote Of The Day

"Success is not for the chosen few; it's for those who choose to persevere." Success is not a matter of luck but a result of unwavering determination and resilience. 🌟 #EmbraceTheChallenge 🌱#PersonalGrowth

Quote Of The Day

Another funny quote I thought I'd share today to start the day with a smile "If you think nobody cares if you're alive, try missing a couple of car payments." – Earl Wilson 🌄 #jokes

March Token Unlocks: HYPE, SUI, WBT, ENA and more

March 2026 is shaping up to be one of the most consequential months in the crypto markets, with over $6 billion worth of tokens scheduled to unlock across multiple networks. From exchange-linked giants like WhiteBIT (WBT) to emerging ecosystems such as Hyperliquid (HYPE), Sui (SUI), and Ethena (ENA), the sheer scale of these releases is … Continue reading March Token Unlocks: HYPE, SUI, WBT, ENA and more

Can BTC Rebound Pump to $72k?

Bitcoin had a sharp rebound in the last couple of days. Right now, the debate isn’t only about “can it go higher”, but whether this rebound marks a structural inflection point or just another relief rally before further consolidation. The 68,000–70,500 USDT zone is the frontline where momentum and conviction will collide. Key Battleground: $66k – $72k Market focus … Continue reading Can BTC Rebound Pump to $72k?

MORPHO Price is Dropping – What Next?

The sudden dip in MORPHO has traders scratching their heads — is this just a short-term pullback before the next leg up, or the start of a deeper unwind? 🤔At its core, this drop feels less like a “trend collapse” and more like a routine respiratory pause after a strong institutional rally — the DeFi … Continue reading MORPHO Price is Dropping – What Next?

🛡️ Importing Seed Phrase Into a Hardware Wallet: Do’s and Don’ts

Importing a seed phrase securely is crucial for crypto safety. Use offline hardware wallets, avoid mobile apps for entry, and never expose your seed to internet-connected devices.

HYPE Price Analysis: Downtrend Deepens…

HYPE’s sudden drop has traders rattled. Is it just a healthy cool-off or the start of a deeper correction? In essence, this is a liquidity and sentiment squeeze: short-term traders are digesting profits after explosive gains, much like a spring compressing before its next rebound. The current drop below the 50 EMA on the daily indicates … Continue reading HYPE Price Analysis: Downtrend Deepens…

ETH Keeps Falling? Ether Price Analysis

ETH’s recent decline feels like déjà vu, another sharp pullback leaving traders torn between whether this is a structural correction or a prelude to a relief rally.Put simply, this dip isn’t random noise; it’s leverage burnout meeting institutional hesitation, like the market taking a deep breath before its next sprint. Reasons behind ETH’s decline Leverage … Continue reading ETH Keeps Falling? Ether Price Analysis

Does the net buying of Bitcoin’s top traders indicate a bullish market outlook?

Bitcoin feels like a coiled spring this week — MicroStrategy’s 2,486‑BTC purchase and the net buying by elite traders have shaken the table again. Everyone’s wondering: is this the spark for the next leg up or just a bear‑trap to reset leverage? Let’s break down the structure and see where the opportunity — and the … Continue reading Does the net buying of Bitcoin’s top traders indicate a bullish market outlook?

Why is the price of $STABLE rising?

STABLE's recent price surge stems from a Binance Alpha airdrop, creating speculative trading activity. Sustainability remains uncertain as market sentiment drives momentum amid high volatility. Find out more...

On This Day In Bitcoin History

Bitcoin hit $50,000 for the first time on this day in February 2021

🚨 Token Unlocks February 2026

February is traditionally a month of transition in the crypto markets, but in 2026, it’s looking more like a "Liquidity Stress Test." In fact, the market is bracing for over $1 billion in total liquidity injections this month. While some are "business as usual" linear releases, a few—specifically Hyperliquid and Berachain—are massive supply shocks that … Continue reading 🚨 Token Unlocks February 2026

TODAY IN CRYPTO HISTORY

It's been 12 years (or 144 months) since Vitalik Buterin announced the concept of Ethereum.

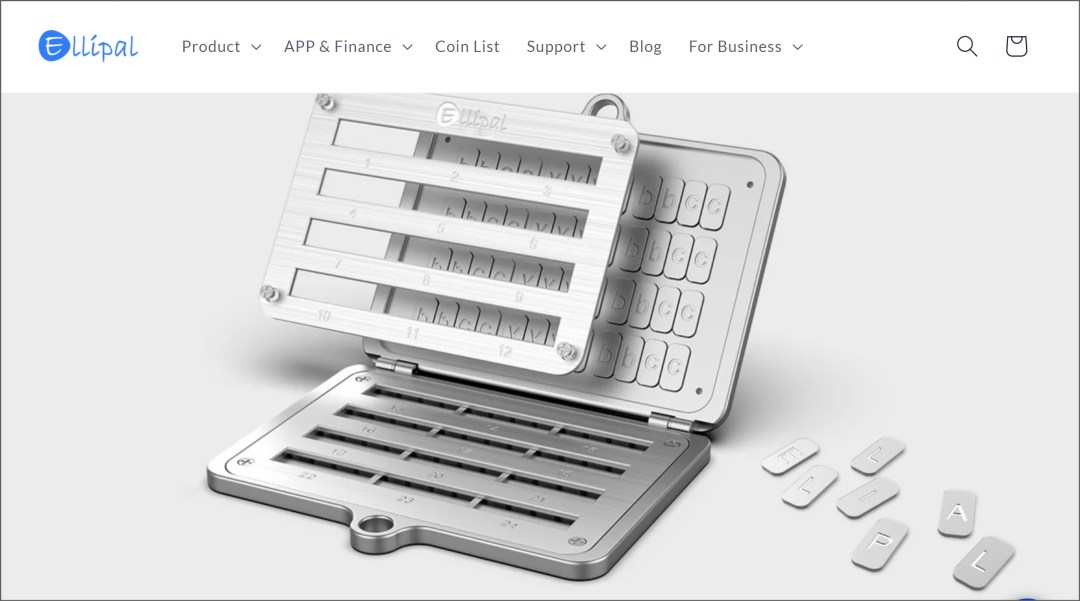

My Top Choice for Safeguarding my Seed | Ellipal Seed Steel Review 2026

To securely store your crypto seed phrase, avoid paper backups in favor of durable, fireproof solutions like the Ellipal Steel Plate, made from resilient 316 stainless steel, ensuring long-term protection and usability against disasters.

On This Day In Bitcoin History

First Bitcoin transaction occurred January 12, 2009, proving functionality.

On This Day In Bitcoin History

It's been just two years after Bitcoin's milestone, the SEC approved 10 spot Bitcoin ETFs, marking a pivotal moment for institutional crypto adoption and mainstream integration in finance.

Ellipal Xcard Breakdown & First Impressions

Ok, so I’ve been in crypto long enough to care about security first, and I only talk about wallets if they actually make sense from a self-custody perspective. If you’re new to my channel, hello! Thanks for tuning in. I’ve been talking about cold wallets for 10 years at this point, so I’ve been using … Continue reading Ellipal Xcard Breakdown & First Impressions

On This Day In Bitcoin History

Bitcoin launched 17 years ago with the creation of the Genesis block.

Major Token Unlocks Coming Up in Jan 2026 (XRP, SUI, XPL & more)

And so December rolled out mostly uneventfully, without any major market hiccups, low volatility and even lower trading volumes are the trend as of right now. But with January kicking in, that means one thing for the cryptocurrency market: the annual supply shock is starting. Across major ecosystems, billions of dollars worth of tokens are … Continue reading Major Token Unlocks Coming Up in Jan 2026 (XRP, SUI, XPL & more)

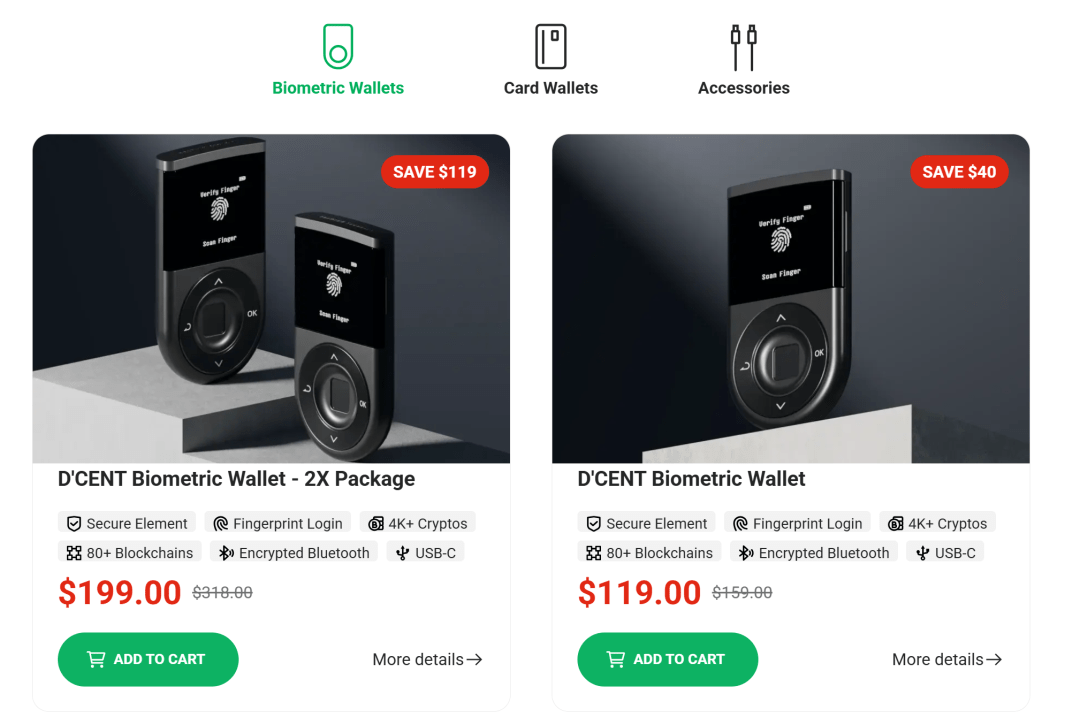

D’CENT’s Year-End Crypto Wallet MEGA-SALE Just Went Live (37% OFF + $85K FREE CRYPTO!)

D'CENT Wallet, a leader in biometric hardware security, has officially launched its Year-End Gala, which is confirmed to be the largest price reduction and rewards campaign of 2025. This promotion not only offers a steep discount on their flagship Biometric Wallet but also connects users with a massive multi-project rewards program. The Deal: Up to … Continue reading D’CENT’s Year-End Crypto Wallet MEGA-SALE Just Went Live (37% OFF + $85K FREE CRYPTO!)

Lock Down Your Crypto: ELLIPAL Kicks Off Holiday Sale with Up to $49 Off the Flagship Titan 2.0

The Ellipal Titan 2.0 is a newly launched secure hardware wallet, upgraded from its predecessor, offering functionality for cryptocurrencies and NFTs. It provides enhanced security, compatibility, user-friendly interaction, and is priced competitively.

These Are The Best Crypto Hardware Wallet Deals This Holiday Season

As we entered the holiday season, securing your digital assets in cold storage is the single most important step for any crypto holder. This holiday season, major hardware wallet manufacturers are battling for your attention with their steepest discounts and most valuable bundles. For those prioritizing transparency and complete control, I can't stress enough the … Continue reading These Are The Best Crypto Hardware Wallet Deals This Holiday Season

On This Day In Bitcoin History

On December 5, 2024, Bitcoin achieved a historic milestone by surpassing $100,000, briefly reaching $103,000. This occurred amidst a recovering market, driven by institutional adoption, positive regulatory changes, and global economic uncertainty. The achievement bolstered Bitcoin’s legitimacy as a financial asset and encouraged further investment and innovation in the cryptocurrency sector.

On This Day In Bitcoin History

On November 29, 2013, Bitcoin first surpassed $1,000 amid a price surge, only to face a steady decline for the next 4 years.

On This Day In Bitcoin History

On this day, exactly 8 years ago, Bitcoin hit $10,000 for the first time in history. Bitcoin first hit the $10,000 mark on November 28, 2017, a significant milestone that occurred during a remarkable price rally throughout that year. This surge was characterized by a series of developments that contributed to Bitcoin's rapid increase in value and its growing prominence in the financial landscape. Of course, looking at the chart, … Continue reading On This Day In Bitcoin History

December 2025 Token Unlocks To Watch Out For

December’s unlock calendar is stacked, with large cliff events like Linea alongside steady monthly vesting from Aptos, Arbitrum, and Avalanche. The mid‑month cluster: Sei, StarkNet and Sui adds extra pressure, while Optimism and Polygon close out the year with sizable governance allocations. For traders and long‑term holders alike, these dates are worth marking, as liquidity … Continue reading December 2025 Token Unlocks To Watch Out For

Hardware Wallets’ Top Black Friday Deals

This year's Black Friday is a prime opportunity to move your crypto to cold storage. Whether you prefer the open-source nature of Trezor, Onekey or BitBox02, the convenience of Tangem, or the air-gapped security of Ellipal/SafePal, there is a deep discount waiting for you. I have gathered the most recent Black Friday and Cyber Monday … Continue reading Hardware Wallets’ Top Black Friday Deals