ETH’s recent decline feels like déjà vu, another sharp pullback leaving traders torn between whether this is a structural correction or a prelude to a relief rally.

Put simply, this dip isn’t random noise; it’s leverage burnout meeting institutional hesitation, like the market taking a deep breath before its next sprint.

Reasons behind ETH’s decline

- Leverage flush After a strong rally in early 2026, speculative long positions became overcrowded. Data shows both long and short liquidations near 4.6 billion USDT if ETH moves 20%, illustrating the tight and volatile leverage structure. As funding rates turned slightly negative (–0.000008), perpetual traders started trimming exposure, accelerating downside momentum.

- ETF and institutional rotation Despite BlackRock’s upcoming staking ETF launch, inflows have stalled following Harvard’s 87 million USDT accumulation. Institutions appear to be rebalancing portfolios – reducing ETH while maintaining BTC exposure. ETF‑linked flows over the last three days were net negative (–182.9 million USDT on Feb 16), suggesting short‑term derisking ahead of the SEC approval window.

- Macro and regulatory caution US macro signals (strong housing data and durable‑goods orders) strengthened the dollar. This limits liquidity entering crypto. Additionally, the US CFTC reaffirmed jurisdiction over prediction markets, keeping ETF approval timelines uncertain and reinforcing a risk‑off environment that weighs on ETH around the 1,900–2,100 USDT zone.

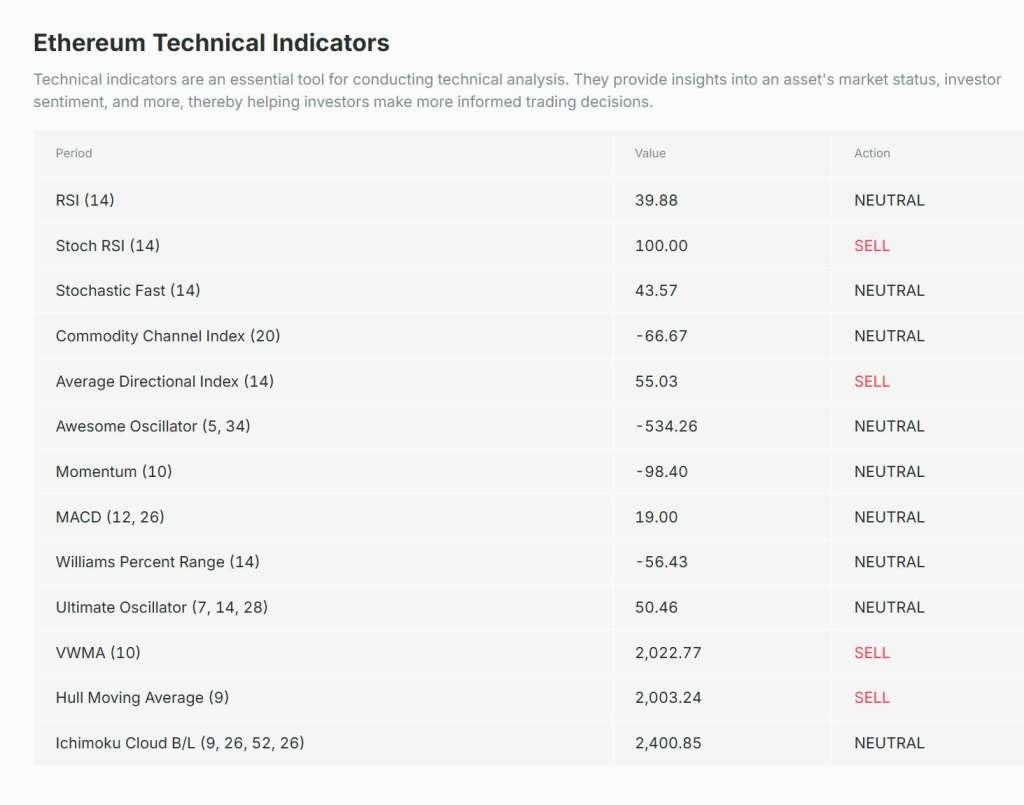

- Technical fatigue Technically, ETH is struggling below its EMA‑50 and Bollinger mid‑band near 1,990 USDT. RSI has dipped into oversold territory (below 30), confirming seller dominance. Support at 1,900 USDT has been tested multiple times; breaking that level could expose 1,750 USDT, the next historic pivot.

Outlook and trading guide

Short‑term rebound window: Overall, the market remains cautious, but a technical opportunity is forming near 1,900 USDT.

- Key pathways

- If ETH/USDT can stabilise above 1,950–2,020 USDT with rising volume, price could test the 2,100–2,150 USDT region for a corrective bounce.

- Conversely, fading momentum could trigger a retest of 1,800–1,750 USDT for bottom validation.

- Data and sentiment

- Multi‑exchange positioning shows 68 % of accounts are long while 32 % short, a long/short ratio near 2.24. This imbalance reflects heavy bullish positioning even as price falls; such crowding often precedes temporary pullbacks.

- Elite traders show slightly higher conviction. Their long/short ratio sits at 2.51, indicating they’re scaling back shorts before key support tests. While funds are net‑outflowing (–289.6 million USDT on Feb 15), neutral funding rates imply selling pressure may soon ease.

- Trend positioning

- Momentum divergence between MACD and RSI signals that downside energy is losing steam. A relief rally toward the mid‑channel could emerge if 1,900 USDT holds.

As the chart below shows, we are forming a local bottom currently, which is the good news. Typically, when we deviate from the 50 EMA on the daily, we are pulled back toward it, which now is sitting around the 2,500 USDT level. A relief rally toward this resistance is a very likely scenario, so great for swing trades. However, this is not the long term trend, just a local swing opportunity, so trade cautiously.

Volatility is still the boss. Whether you choose to chase the rebound or sit on your hands, remember the market always rewards patience over panic!!!

Keep alert about the latest news and events in crypto. Follow this page and find me on:

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.

Recommended:

👉 Sign Up for the Crypto Corner Newsletter and join 10,000+ users to receive my monthly updates and market analysis and keep up to date with the latest releases and developments in the crypto arena.

👉 Sign Up for the Crypto Corner Newsletter and join 10,000+ users to receive my monthly updates and market analysis and keep up to date with the latest releases and developments in the crypto arena.

📖Free eBook “Best Crypto Wallets” is the best guide for all the top-performing crypto wallets. Both hot and cold wallets are reviewed by me and from personal experience.

📖Free eBook “Best Crypto Wallets” is the best guide for all the top-performing crypto wallets. Both hot and cold wallets are reviewed by me and from personal experience.

👉Brave Browser is my top choice for extra security while browsing online. It is privacy-oriented, web3-enabled and blocks unnecessary cookies and much more: https://brave.com/ojj095

👉Brave Browser is my top choice for extra security while browsing online. It is privacy-oriented, web3-enabled and blocks unnecessary cookies and much more: https://brave.com/ojj095

💻Find me on:

⚠️ DISCLAIMER ⚠️

The information contained in this video is for informational purposes only. Nothing herein shall be construed to be financial or legal advice. The content of this post reflects solely my own opinions. Purchasing cryptocurrencies poses considerable risk of losses.

HYPE Price Analysis: Downtrend Deepens…

HYPE’s sudden drop has traders rattled. Is it just a healthy cool-off or the start of a deeper correction? In essence, this is a liquidity…

Does the net buying of Bitcoin’s top traders indicate a bullish market outlook?

Bitcoin feels like a coiled spring this week — MicroStrategy’s 2,486‑BTC purchase and the net buying by elite traders have shaken the table again.…

Why is the price of $STABLE rising?

STABLE’s recent price surge stems from a Binance Alpha airdrop, creating speculative trading activity. Sustainability remains uncertain as market sentiment drives momentum amid high…