Christine Lagarde (European Central Bank President) declared last week that the European Union’s Digital Euro (CBDC) will enter its final preparation phase for an October launch. We now have less than 6 months to discuss the pros and cons before we are faced with them forcefully and abruptly.

Lagarde’s vision (of enhanced payment efficiency and financial inclusion) masks a reality where the digital euro could become a powerful tool for centralized control. We’re faced with alarming risks to privacy, autonomy, and democratic oversight.

For a start, the definition of a Central Bank Digital Currency is a “digital form of money issued and regulated by a central bank, designed to complement or replace physical cash”.

Unlike private cryptocurrencies, CBDCs are backed by a government and pegged to the value of a nation’s fiat currency, and are the nations’ legal tender. That is all fine, at least at face value. For many people the jump from cash to digital has already happened with Western countries abandoning cash for card payments more and more aggressively in the past couple of years. Digital transactions are not a novelty and the switch to digital cash seems logical and consistent with our advancements in technology over time. However, CBDCs present us with some serious red flags that should be discussed in more depth and ultimately – these have to be put to a vote by nations, rather than selected few.

One of my main arguments against CBDCs is that they avoid decentralised (blockchain) technology, instead relying on centralized systems for efficiency and control. Control being the operative word here.

While I agree that CBDCs may streamline transactions and improve financial inclusion, we ought to take into account the limitations of personal freedom and privacy risks that arise from the use of Central Bank Digital Currencies. In effect, we’re looking at mandatory digital IDs that could exclude marginalized groups, and with traceable nature that enables state surveillance, threatening privacy and enabling behavioral control through restrictions on purchases or social scoring. It’s a concept not quite forgotten by those of older generations who lived through rationing and coupons.

At first glance, the narrative in favour of a Digital Euro centers on monetary sovereignty, financial innovation, and strategic autonomy, with the European Central Bank (ECB) positioning it as essential to maintaining the euro’s global relevance and reducing reliance on foreign payment systems like Visa or Mastercard. ECB President Christine Lagarde frames the digital euro as a tool to “future-proof” the currency and counter the rise of private cryptocurrencies, which the ECB views as destabilizing. Proponents argue it will streamline payments, eliminate transaction fees, and provide access to state-backed money for unbanked populations, replicating cash’s universality in digital form.

The ECB also claims to balance privacy with anti-money laundering (AML) compliance, proposing offline transactions that mimic cash-like anonymity, though even these would require identity verification for larger sums.

However, tensions persist: the European Parliament insists the digital euro’s launch must be a shared political decision with the ECB and EU Council, citing risks to privacy, consumer rights, and financial stability.

Critics warn the ECB’s design enables real-time transaction monitoring, with offline payments facing usage caps that force users into traceable systems for routine spending. Combined with AI, this data could enable social profiling, undermining privacy assurances. Technical risks also loom, including cybersecurity vulnerabilities highlighted by a February 2025 outage of the ECB’s T2 payment system, and exclusion risks for cash-dependent populations due to mandatory digital IDs and device requirements.

Below, I outline four core arguments against CBDCs like the digital euro, supported by emerging evidence from the ECB’s own plans and global CBDC experiments.

1. Programmable Surveillance Infrastructure

The digital euro’s architecture grants governments real-time visibility into citizens’ financial lives:

- Transaction Monitoring: Unlike cash, all CBDC transactions leave digital trails. The ECB admits the digital euro will comply with anti-money laundering (AML) laws, requiring identity-linked wallets for larger transactions. Even “privacy-focused” offline payments face usage caps, forcing users into traceable systems for routine spending.

- Behavioral Control: Lawmakers warn programmable features could let authorities restrict purchases of “non-compliant” goods (e.g., fossil fuels, unapproved media) or enforce spending limits during crises (remember the toilet paper shortages during the pandemic). China’s digital yuan already blocks transactions to dissidents, a precedent the EU risks emulating.

- Data Exploitation: ECB officials claim metadata will only serve “public good” purposes, yet provide no legal safeguards against profiling or misuse. Combined with AI, transaction histories could enable social scoring akin to China’s system.

2. Systemic Financial Control

CBDCs represent a significant shift in financial power, transferring control from individuals and commercial banks to central authorities. One of the most concerning aspects is the elimination of cash, as the push for digital dominance pressures reliance on physical currency. Sweden’s experience with its e-krona trials, where cash usage plummeted dramatically, suggests a similar trajectory for the European Union, raising fears of a cashless society that could marginalize those who rely on physical money. Additionally, CBDCs could be weaponized geopolitically; a 2025 EU Parliament report warns they might enable sanctions to bypass or exclude “non-compliant” nations from financial systems. Conversely, interoperability between CBDCs could create a global surveillance network, amplifying state control over financial flows. Furthermore, the risk of bank disintermediation looms large. While the European Central Bank (ECB) plans to cap digital euro holdings to prevent destabilizing withdrawals from commercial banks, these caps could be adjusted during crises to redirect capital, thereby undermining individual financial autonomy. These dynamics highlight how CBDCs could centralize financial power while eroding personal and institutional independence.

3. Cybersecurity and Exclusion Risks

Centralized systems, such as those proposed for Central Bank Digital Currencies (CBDCs), are inherently vulnerable to catastrophic failures and exclusion. A single cyberattack could compromise millions of financial histories, as demonstrated by the European Central Bank’s T2 payment system outage in February 2025, which exposed critical weaknesses in centralized infrastructure. Additionally, the reliance on mandatory smartphones or digital IDs for CBDC access risks excluding significant portions of the population, particularly those without reliable internet access, creating a digital divide that undermines financial inclusion. Technical glitches further exacerbate these vulnerabilities; the ECB’s TIPS system, a model for the digital euro, has already faced criticism for transaction delays during peak hours. These risks highlight the fragility of centralized systems and raise serious concerns about their ability to withstand cyber threats while ensuring equitable access to financial services.

4. Undemocratic Implementation

The rollout of the digital euro has already raised significant concerns about the lack of public consent and transparency in its development but still many people are unaware of this and don’t understand the complexities and threats that digital cash will impose. European Central Bank (ECB) President Christine Lagarde is pushing for an October 2025 launch, even as debates within the European Parliament over privacy safeguards and financial stability remain unresolved. Key decisions about the digital euro’s design and infrastructure are being made by ECB technocrats, sidelining broader democratic input. Moreover, private contracts worth €1 billion have already been awarded to technology providers without sufficient public transparency, while citizens remain excluded from meaningful participation in design discussions. Once implemented, the digital euro would set an irreversible precedent; dismantling such a system would be politically untenable, as illustrated by Nigeria’s failed eNaira rollout, where authorities doubled down on a flawed system rather than admit failure. This lack of public involvement and accountability underscores the risks of centralizing financial power without adequate democratic oversight.

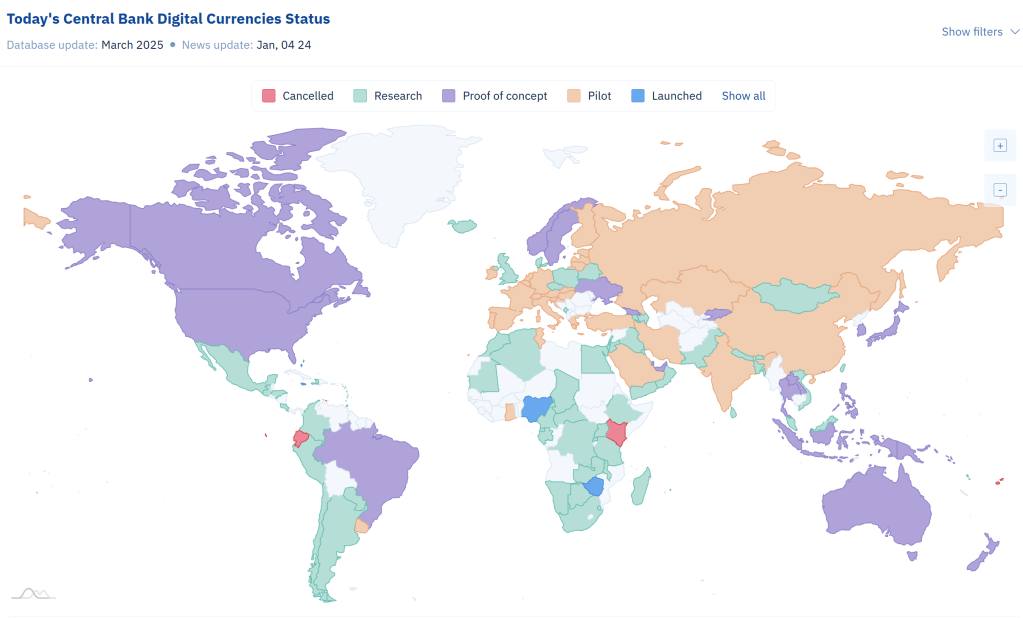

As of today, according to data from Atlantic Council’s CBDCs tracker, 134 countries & currency unions, representing 98% of global GDP, are exploring a CBDC. Just 5 years ago that number was 35.

Currently, 65 countries are in the advanced phase of exploration—development, pilot, or launch and 4 countries have already launched their CBDCs: Nigeria, The Bahamas and Jamaica, with 44 countries being in pilot stage. Europe is starting this October.

Time is running out for those who are in opposition to these systems.

What I propose:

We must focus on key safeguards to protect privacy and financial autonomy. First, legally binding privacy measures are essential, demanding encryption standards that prevent transaction tracking beyond anti-money laundering (AML) requirements. While encryption can secure sensitive data like transaction histories and account balances, it must also ensure that users retain control over their financial information rather than central authorities exploiting it for surveillance purposes. Second, cash preservation must be prioritized by enshrining physical cash as a constitutional right to prevent forced digitization, as seen in countries like Sweden, where cash usage plummeted after CBDC trials. Without this safeguard, marginalized populations reliant on cash could face exclusion. Finally, open-source audits of CBDC systems should be mandatory to detect backdoors or control features embedded in the code. Public verification would ensure transparency and accountability in the design of CBDCs like the digital euro, which has already raised concerns over rushed implementation and limited public oversight. As the EU moves forward with its plans, these measures are critical to ensuring that CBDCs serve as tools of empowerment rather than instruments of control.

My goal with this post is to bring awareness and hopefully to get more people involved in the discourse about this before it’s too late, albeit, October is just around the corner.

The digital euro isn’t innovation; it’s digitized authoritarianism.

Without immediate pushback, Europe risks trading fleeting convenience for permanent subjugation.

Central Bank Digital Currencies (CBDCs) could fundamentally reshape the global economy through structural shifts in monetary policy, financial stability, and geopolitical dynamics. Their long-term impacts hinge on design choices, but emerging trends suggest transformative—and potentially destabilizing—effects. CBDCs may alter how central banks manage economies, enabling real-time monetary policy adjustments through programmable features, but also risking financial instability if remunerated CBDCs incentivize depositors to withdraw funds during crises, triggering bank runs. The financial sector faces disintermediation as CBDCs reduce commercial banks’ deposit bases, forcing reliance on costlier funding, while private cryptocurrencies risk suppression under state-backed alternatives. The erosion of cash will further limit people’s personal freedom, introducing surveillance of unprecedented nature. Geopolitically, foreign CBDCs could dominate in low-income nations, eroding local monetary sovereignty and creating dependency on external policies, while interoperability challenges between systems risk fragmenting global payment networks. Macroeconomic policy flexibility could expand with granular transaction data, but CBDCs might also amplify deflationary pressures in low-inflation environments. Ultimately, CBDCs’ long-term trajectory depends on balancing innovation with governance frameworks that prioritize privacy, equity, and democratic oversight. Without these safeguards, they risk deepening inequality, entrenching surveillance, and destabilizing global financial systems—a reality underscored by over 100 active CBDC projects worldwide. Urgent international dialogue is needed to navigate these risks and ensure CBDCs serve public good rather than state control. As of right now, from where I’m standing, the Digital Euro and many other CBDCs that are in development around the world present more opportunities for state control rather than serve public good and this is my main fear about the October launch of the digital euro.

Recommended:

👉Sign Up for the Crypto Corner Newsletter and get more insight on the crypto markets, new releases and updates, plus my personal choice of coins to trade.

👉Sign Up for the Crypto Corner Newsletter and get more insight on the crypto markets, new releases and updates, plus my personal choice of coins to trade.

📖Free eBook “Best Crypto Wallets” is the best guide for all the top-performing crypto wallets. Both hot and cold wallets are reviewed by me and from personal experience.

📖Free eBook “Best Crypto Wallets” is the best guide for all the top-performing crypto wallets. Both hot and cold wallets are reviewed by me and from personal experience.

👉 LearnCryptoNow is the go-to place to get valuable resources and learn more about blockchain tech and all things crypto-related: https://www.learncryptonow.com/

👉 LearnCryptoNow is the go-to place to get valuable resources and learn more about blockchain tech and all things crypto-related: https://www.learncryptonow.com/

👉Brave Browser is my top choice for extra security while browsing online. It is privacy-oriented, web3-enabled and blocks unnecessary cookies and much more: https://brave.com/ojj095

👉Brave Browser is my top choice for extra security while browsing online. It is privacy-oriented, web3-enabled and blocks unnecessary cookies and much more: https://brave.com/ojj095

👉Token Metrics is the platform I use for uncovering unknown gems and to monitor my crypto watchlist. They have the most detailed statistics and analysis for all major cryptocurrencies and price predictions to help you find the right coins to trade and the right time to buy/sell – give it a try and get 10% discount: https://bit.ly/token_metrics

👉Token Metrics is the platform I use for uncovering unknown gems and to monitor my crypto watchlist. They have the most detailed statistics and analysis for all major cryptocurrencies and price predictions to help you find the right coins to trade and the right time to buy/sell – give it a try and get 10% discount: https://bit.ly/token_metrics

Want to know how to make money by investing in crypto?

Grab a copy of my best-selling eBook “Learn Crypto” to find out all about the cryptocurrency market, the different blockchains and the “Do”s and “Don’t”s of how to build a successful crypto portfolio. It’s now in its second edition.Find out more: LearnCryptoNow.com

“Crypto Wallets” is a Free eBook to guide you in choosing the right wallet for you. All the popular Hot and Cold Wallets are reviewed in this useful guide, most of which I personally use, or have used in the past. Self-custodial and custodial services too.

Find out more at: https://www.ojjordan.com/crypto

⚠️ DISCLAIMER ⚠️

The information contained in this video is for informational purposes only. Nothing herein shall be construed to be financial or legal advice. The content of this post reflects solely my own opinions. Purchasing cryptocurrencies poses considerable risk of losses.

HYPE Price Analysis: Downtrend Deepens…

HYPE’s sudden drop has traders rattled. Is it just a healthy cool-off or the start of a deeper correction? In essence, this is a liquidity…

ETH Keeps Falling? Ether Price Analysis

ETH’s recent decline feels like déjà vu, another sharp pullback leaving traders torn between whether this is a structural correction or a prelude to…

Does the net buying of Bitcoin’s top traders indicate a bullish market outlook?

Bitcoin feels like a coiled spring this week — MicroStrategy’s 2,486‑BTC purchase and the net buying by elite traders have shaken the table again.…