Bitcoin is just 44 days away from its 4th Halving event and the market has been pumping hard in the last month. 52% up in the last 30 days alone. It’s a great performance indeed.

We’ve seen such pre-halving rallies every 4 years, so this is not exactly a surprise. But BTC managed to hit its previous ATH yesterday, which makes this even rather unusual. This, we have not seen before. Typically, BTC reaches its previous ATH only several months after the halving, since it has gone through a bear cycle, where it has dropped by some 80% and more. The recovery is usually slow and takes over a year, followed by another 1.5 years of a stronger bull cycle, where we see new ATH being printed.

What makes the big difference this time around, is that we now have spot BTC ETFs (10 in the US and a few more in Europe & Canada), which opened the doors to institutional investors to dump their billions into the asset. This is unprecedented, and just as we’ve been discussing for a long time, the appetite for the asset is at its highest right now.

With that said, should we expect a market correction in the last weeks before the halving?

I think so.

There are several indicators I can point out to, in support of this.

First, it is very common for any asset to see a correction after a strong pump and as of right now, BTC is seeing a 67% pump since the start of this year without any significant correction. We can’t keep going to new highs without a reasonable pullback, it’s just not sustainable. We could, of course, go higher and pump even harder, before we experience a decent pullback, but in my opinion, the previous ATH is a good time for many investors to lock-in some profits and hit the sell button. It’s also very close to the 70k mark (which is a round number and thus, a psycological resistance level too).

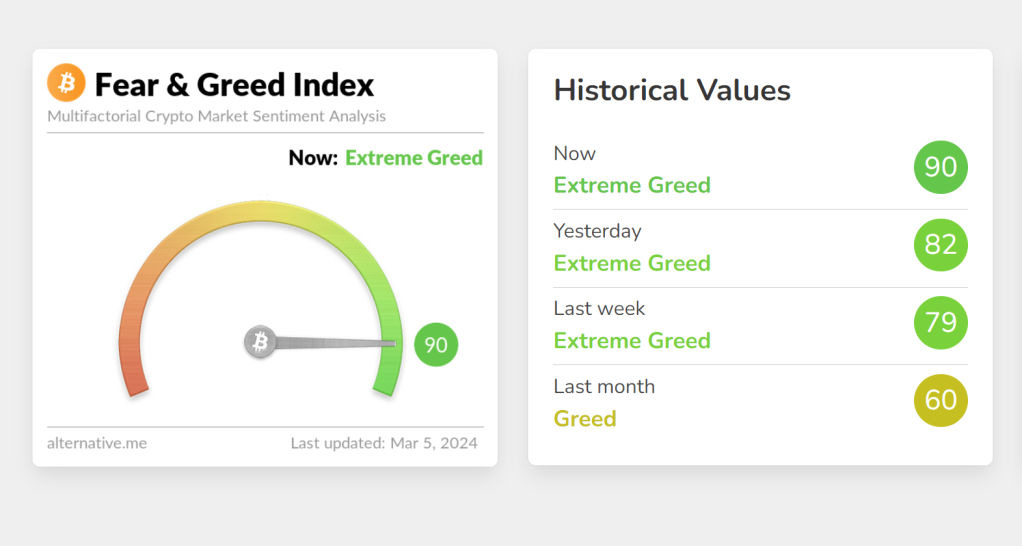

Then we have the ‘Fear and Greed Index’ touching the 90% – a level that we very rarely see and one that is certainly a Red Alert.

And the MVRV ratio is flashing red alert. It’s another popular indicator used to gauge the profit and loss of Bitcoin holders, and has reached a critical threshold that has historically been a precursor to significant price corrections. It is now touching the 20% mark, which is a rare occurence. Typically, whenever this indicator surpasses the 18% mark, it is followed by a notable decrease in Bitcoin’s price, ranging between 24% to 55%.

The MVRV ratio is a valuation metric that compares the market value (the current price) of Bitcoin to its realized value (the average price at which each Bitcoin last moved). A high MVRV ratio suggests that the price is overvalued relative to its “fair” value, which can lead to a sell-off, while a low ratio indicates undervaluation. With the ratio currently sitting at 19.57%, there is a growing concern among traders and investors about a potential steep price correction coming up. However, the potential for volatility is underscored by recent market activities. According to CoinGlass data, there has been a total of $158.37 million in Bitcoin liquidations over the last 24 hours. Breaking this down further, $65.31 million were in long liquidations, while short liquidations accounted for $93.07 million.

The speculation is in full force, with many bulls calling for a new ATH, while bears are already selling in anticipation of a 20-30% correction. Who is right and who is wrong, only time will tell. I am expecting a correction, but my strategy is different this time. Since the start of this year I am simply accumulating and increasing my positions in alts. The BTC rallies are often followed by even bigger altcoins rallies and at time when BTC corrects, alts will be bleeding hard too, which is giving me the opportunity to add to my positions at low prices. As a position trader, I do not bother with the short term swings in a bull market, but rather, I wait for major price moves to place my buy and sell orders, thus making much bigger profits on bigger moves and with less number of trades. It’s an easier strategy that the one I adopt during a bear market, where I trend to swing trade and do more short-term, higher frequency trading.

From my experience over the last 7 years, this is the most adequate trading style for me, but I’m not saying it’s the only way to play these markets. You need to follow your gut and use your strengths to your advantage.

With that said, will I be selling at this peak of the market?

To some degree.

I currently hold about 40+ altcoins and most of these are at 100+% profit from my entries. I will pick about 10, which I will scalp (i.e. I will take some profits and sell up to a third or more of my stash) and I will re-accumulate them at the dips that will follow. I will do that with BTC too.

This will also be a good time to maybe re-allocate capital to other alts that I have been watching, but did not jump into previously.

You see, when BTC bleeds by 5%, alts tend to bleed by 20%. And if BTC corrects by more than 10%, then alts will be in the red by 30% and more. If you’re able to buy an alts at 30% or 40% discount, then of course, it makes sense to do that instead of holding it throughout a lengthy correction.

But there is a risk in this strategy too. The risk is, if BTC simply holds onto its price and instead of correcting, it goes sideways, consolidating for some time, thus opening the door for alts to boom and see much bigger pumps instead.

Which is why I am talking about scalping only a portion of my alts portfolio, rather than a heavy sell-off and exiting positions entirely.

With the ETFs aggressively buying BTC over the last month, I don’t really see a case for a 30% or even 20% correction in BTC this time around. Back in 2017 and even in 2020, we had such corrections. Several times. But are we going to see Bitcoin drop below $50k in the coming weeks? Is it likely? I doubt that.

A 30% correction would send BTC down to $48k again (the orange zone in my chart), and erase all the gains made over the last 30 days. It’s not impossible, but I don’t see this as the most likely scenario right now. I’m watching out for key support levels of $63k and $58k (which I determined from a Fib retracement levels) and this is where I’m placing some buy orders.

As for the alts, they too will be seeing some red days for sure. If you’ve been buying alts during this latest pump, you might want to lock-in some profits and try to re-buy at the dips. Or maybe you’re a long term investor and the short term swings don’t really matter to you – whatever your trading style, I hope this makes sense and helps you make more-informed decisions for your own portfolio.

Recommended:

👉 Sign Up for the Crypto Corner Newsletter and get more insight on the crypto markets, new releases and updates, plus my personal choice of coins to trade: https://www.ojjordan.com/crypto-corner

👉 Sign Up for the Crypto Corner Newsletter and get more insight on the crypto markets, new releases and updates, plus my personal choice of coins to trade: https://www.ojjordan.com/crypto-corner

👉 LearnCryptoNow is the go-to place to get valuable resources and learn more about blockchain tech and all things crypto-related: https://www.learncryptonow.com/

👉 LearnCryptoNow is the go-to place to get valuable resources and learn more about blockchain tech and all things crypto-related: https://www.learncryptonow.com/

👉Brave Browser is my top choice for extra security while browsing online. It is privacy-oriented, web3-enabled and blocks unnecessary cookies and much more: https://brave.com/ojj095

👉Brave Browser is my top choice for extra security while browsing online. It is privacy-oriented, web3-enabled and blocks unnecessary cookies and much more: https://brave.com/ojj095

👉Token Metrics is the platform I use for uncovering unknown gems and to monitor my crypto watchlist. They have the most detailed statistics and analysis for all major cryptocurrencies and price predictions to help you find the right coins to trade and the right time to buy/sell – give it a try and get 10% discount: https://bit.ly/token_metrics

👉Token Metrics is the platform I use for uncovering unknown gems and to monitor my crypto watchlist. They have the most detailed statistics and analysis for all major cryptocurrencies and price predictions to help you find the right coins to trade and the right time to buy/sell – give it a try and get 10% discount: https://bit.ly/token_metrics

Want to know how to make money by investing in crypto?

Grab a copy of my best-selling eBook “Learn Crypto” to find out all about the cryptocurrency market, the different blockchains and the “Do”s and “Don’t”s of how to build a successful crypto portfolio. It’s now in its second edition.Find out more: LearnCryptoNow.com

“Crypto Wallets” is a Free eBook to guide you in choosing the right wallet for you. All the popular Hot and Cold Wallets are reviewed in this useful guide, most of which I personally use, or have used in the past. Self-custodial and custodial services too.

Find out more at: https://www.ojjordan.com/crypto

⚠️ DISCLAIMER ⚠️

The information contained in this video is for informational purposes only. Nothing herein shall be construed to be financial or legal advice. The content of this post reflects solely my own opinions. Purchasing cryptocurrencies poses considerable risk of losses.

Quote Of The Day

“The only person you should try to be better than is the person you were yesterday.” Constantly strive to surpass your previous self, for…

Top Layer 1 Blockchain Networks

The top Layer-1 blockchains like Ethereum, Solana, and Avalanche are making significant impacts due to their scalability, decentralization, and interoperability, while others like Cardano…

Quote Of The Day

“The only limit to our realization of tomorrow will be our doubts of today.” – Franklin D. Roosevelt Doubts can be the only obstacles…