As part of the Crypto Jargon series, this post will focus on the abbreviations you will find mostly in trading signals and technical analysis on social media.

When posting signals, traders use loads of slang to save time and to keep their message short, for convenience, especially on twitter or telegram.

I won’t be breaking down the meaning of each term here, I did that already throughout these series, so hopefully you’ve seen the previous episodes of Crypto Jargon which are hosted on this page.

I also published a quick eBook guide with all the trading terms and abbreviations, which you can get for free from this invite page.

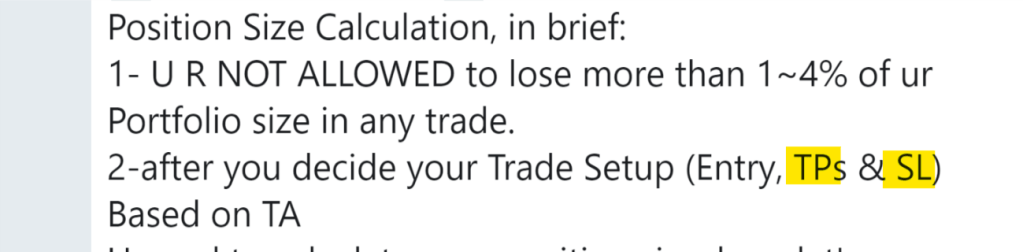

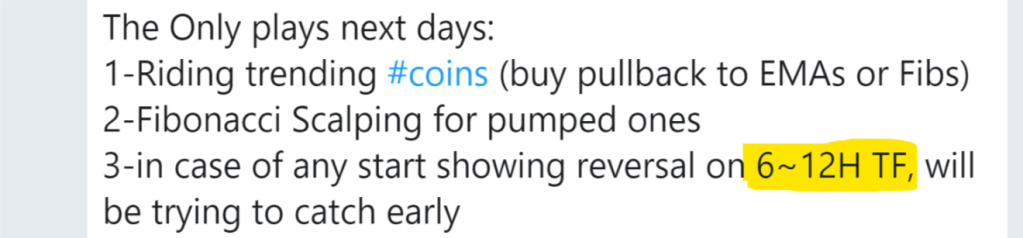

So here are a few examples of trading signals and how things are abbreviated which can be confusing to anyone who is not a seasoned trader.

Let’s see what do these mean:

S is for Short – meaning buy.

L is for Long – meaning sell.

S/R is short for Support and Resistance (explained in this post).

SL is Stop Loss – this is the price level where you should set a sell order (a stop loss order that is) so that you can exit a trade if the market dumps or turns against you. Stop loss is explained in another post about trading slang here, so you can check it out.

TP is Target Price or it can also mean Take Profit which refers to the price where one is aiming to sell at. Sometimes there are two or three target prices depending on the analysis.

EP stands for Entry Price.

EW is Elliot Waves (type of charting analysis explained here).

RL is the Resistance Line or Resistance level

TL is for Trend Line

TF is Time Frame (referring to the chart we are looking at – whether it’s a daily candlestick chart or hourly, 30min, 15 min etc… )

HTF is for Higher Time Frame (hourly, daily, weekly…)

LTF is a Lower Time Frame (minutes)

R:R stands for Risk:Reward Ratio, in other words, what is the risk you take compared to the profit you might gain from that trade. The higher that ratio, the better (1:4 is definitely better than 1:1.5 for instance).

Fib is short for Fibbonacci Retracement Levels (explained here).

MAs are Moving Averages (trend lines that trace the average price movement on various timeframes).

DMA is the Daily Moving Average.

WMA is the Weekly Moving Average.

EMA is the Exponential Moving Average.

SMA is the Simple Moving Average.

RSI is another indicator called Relative Strength Index.

MACD is Moving Averages Convergence-Divergence.

H&S – Head and Shoulders pattern.

C&H – Cup and Handle pattern.

Big Cap is for coins with a large market capitalization.

Small Cap is for those with a small market cap, in other words cheap coins but let that not fool you, they don’t always have the potential to grow and become big, so research them well and please, don’t think that if you don’t have a lot of capital to work with, you should focus on cheap coins or those with a small cap… these things are not connected at all.

Sometimes it’s best to buy small amounts of Bitcoin instead of larger amounts of a cheaper coin because the cheaper coin might not perform as well as Bitcoin.

The price alone has nothing to do with the performance of the coin.

You can see all of these terms in today’s episode of Crypto Jargon video series below and make sure you check out this page on my website, where you will find all of the Crypto Jargon episodes in case you missed them.

Get the eBook Trading Jargon for FREE from this link:

http://ojjordan.com/tradingjargon

OTHER POSTS YOU MIGHT LIKE:

Most Common Trading Patterns Explained

Welcome to another Crypto Jargon article. In a previous post I outlined what is Support and Resistance, also a Breakout and a few of the indicators that help forecast them, and I also mentioned the Wedge Pattern, which is one of the patterns signalling a bullish or bearish potential. In this post I will add…

Alt Season, Bull & Bear Market, Whale, Dolphin, Shark… Explained

Welcome to another Crypto Jargon post. These are my free series of articles where I break down the complex crypto terminology, acronyms and trading slang. Today’s terms are: Alt Season, Bull Market and Bear Market, and a few fish-related slang such as Whale and Dolphin. Let’s start with Alt Season. This is a trading slang…

Long vs Short, Breakout vs Fakeout, Bear Trap vs Bull Trap, Black Swan – Explained

This is part of my Crypto Jargon series where I’m breaking down the most used crypto terms, acronyms and trading slang. Today’s terms are all related to trading and you’ll often see them in market analysis and on social media, especially in regards to cryptocurrency price predictions on twitter and forums or trading signals. Let’s look…

Cephalexin Taste

LikeLike

lasix blood pressure

LikeLike

Zithromax

LikeLike

https://buyplaquenilcv.com/ – Plaquenil

LikeLike

https://buylasixshop.com/ – Lasix

LikeLike

https://buypriligyhop.com/ – Priligy

LikeLike

http://buyzithromaxinf.com/ – zithromax

LikeLike

Ivermectin Online

LikeLike

Cialis 5 Quotidien

LikeLike